Taxes

Perhaps the most dramatic yet easily implemented proposal for change in The Commonsense Rules is the 50-50 plan. It is based on the natural law of sharing, the truism that all people own the land and other natural resources in common. These resources are most effectively utilized, and conflicts are minimized, when productive natural resources are privatized. Private ownership is an expropriation of everyone’s natural rights that must be compensated. Also, the knowledge that has accumulated throughout human history is a common legacy that must also be shared.

The common elements (natural resources and legacy knowledge) of production are at least equal in value to the private labor applied to them. The result of this analysis is that the value of everything produced in the economy and other income associated with a productive society should be taxed at 50 percent. This common half of productive activity is to be collected and used to pay for all the common expenses—the activities of government. The balance of this common fund (after deducting the expenses of government) would then be returned to all citizens.

The proposal calls for this 50 percent tax to replace all other existing taxes on income and consumption (sales) at the federal, state, and local levels. The return of the balance of the common funds to all citizens would replace virtually all existing benefit programs (health care and education are dealt with separately). All citizens would be entitled to receive shares, to be funded at least monthly into special Bank accounts called UShares.

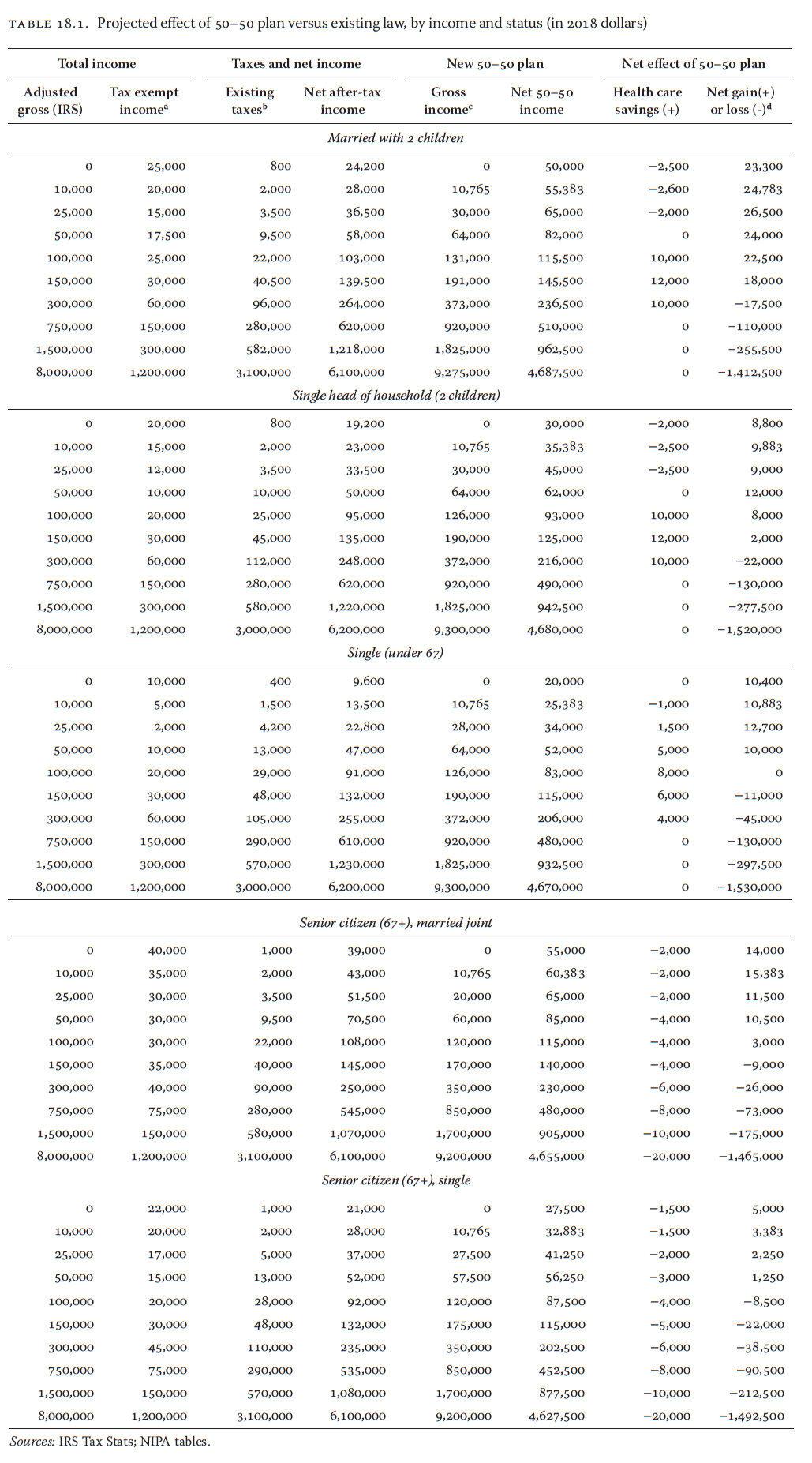

The estimated distributions for 2018, the proposed first year of the new plan, would be $20,000 per adult citizen, $5,000 per child, and $27,500 (a $7,500 senior supplement) for every citizen 67 years of age and older (as further explained in the book). The 50-50 plan would shift at least half a trillion dollars (in 2018 dollars) annually from the highest income Americans to those with middle, low, and no incomes (compared to existing tax laws). The vast majority of citizens would never have to file a tax return again.

As demonstrated in the book, this historic change in the way income and wealth are taxed and distributed would revitalize and continually rebalance the economy, eliminate poverty among Americans, and have other dramatic social benefits. It only seems radical because our tax laws have strayed so far away from fairness and natural rights. To see an estimate of how this change would affect individuals and households at different income levels, check the charts below.

aTax exempt income amounts to approximately 20 percent of taxable income in the aggregate, according to an extrapolation of data from

IRS income tax reporting for 2011 and personal income estimates of the BEA, as shown in NIPA table 2.1. Tax exempt income includes

employer and employee deferred retirement contributions; employer-paid health, life, and disability insurance, and other workplace

benefits (childcare, etc.); unrealized capital gains, municipal interest, and multiple other exclusions from adjusted gross income (AGI)

as defined by the internal revenue code. These sources of income would be paid directly and taxed under the new plan. Other sources of

nontaxable income in the form of government benefits (primarily Social Security income) are included in the estimates of total income

above.

bExisting taxes include all personal taxes on income and sales at the federal, state, and local levels, including payroll taxes deducted from

employees and paid by the self-employed, but do not include employer-paid payroll (primarily FICA) taxes.

cGross income under the 50–50 plan excludes existing government benefits and includes all other forms of income that are currently

taxable as well as nontaxable. Under the new plan, all employer benefits (retirement plans, health insurance, etc.) would be paid directly

to employees and treated as income. Employer-paid payroll taxes (primarily FICA) would be added to the income paid to employees and

taxed as such under the plan.

dThe net gain or loss from the new tax and share plan is a conservative estimate of the benefits of the plan. It does not include the present

value benefit of eliminating the deferred taxation of the existing qualified retirement contributions, which would significantly increase the

financial advantage of the new plan.